Every Pakistani is now able to get a loan from the Akhuwat Foundation. Akhuwat Loan Scheme 2024 is announced in October for the People of Pakistan. The scheme provides a low-cost loan in the amount of 5 million and an amortization period that is 10 years. The Akhuwat Foundation interest-free loan program is available to Pakistani citizens and can be applied anywhere in Pakistan. The money range for different loan products is varied, but it can vary from 50000 to 150000 rupees. The registration for the Akhuwat Loan Scheme has begun. The Akhuwat Loan Government of Pakistan is now active. All Pakistanis in the lower class can now get loans without interest from the Akhuwat Foundation. You will be informed if the Foundation requires you to provide the correct answers. The Akhuwat Foundation is a non-profit organization that aims to eliminate poverty in Pakistan by giving out interest-free loans.

The government has launched in the year 2000, the government launched the Pakistan mere Ghar program for 2024. All Pakistanis are required to build a home by 2024, using loans through the Akhuwat Foundation, and through the Akhuwat Loan Scheme for 2024. This article provides all the details about the loan from the Akhuwat Foundation Scheme.The application fee is 200, except for agriculture. After completing the Qard-e-Hasan loan application form, a man can get the interest-free loan Akhuwat Foundation loan form. Once the Download has been completed, write down all the necessary stuff and then send it to the AIM branch nearest your home. Your loan application is reviewed by the unit manager. The manager also reviews any additional information and confirms that all documents are required for loan approval.

Akhuwat Loan Scheme 2024 Online application link is available now. The Akhuwat Loan Scheme 2024 program was launched by the Pakistani government. Every Pakistani currently can avail a loan from the Akhuwat Foundation. I’ll provide you with a few details in this article available The primary goal for this loan scheme of the Akhuwat Foundation about this Loan scheme is the alleviation of poverty in Pakistan to achieve this goal. Akhuwat Foundation constantly worked hard and provided the loan scheme 2024 to Pakistani people with low interest.

Akhuwat Loan Calculator

Akhuwat the loan amount varies between PKR 10,000 to PKR 100,000, based on the needs of the borrower and their capacity to repay. The loan is offered for between 12 and 18 months. The applicant is required to pay back this loan over a period of monthly payments. The loan is able to be used for a variety of purposes, for example, the start of a small-scale business, financing educational expenses, or medical costs.

How To Apply For Akhuwat Loan

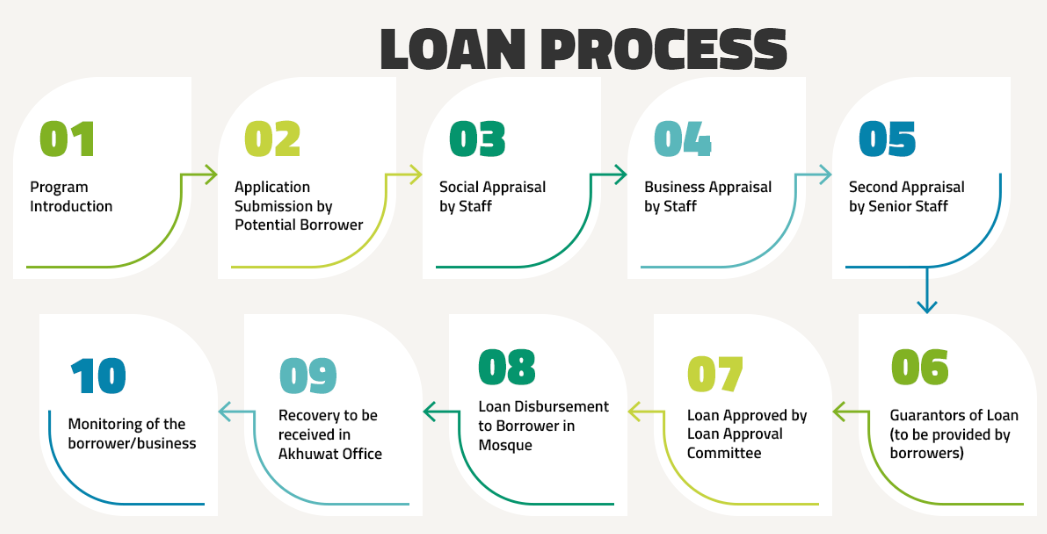

In order to apply for Akhuwat Loan Scheme To apply for the Akhuwat Loan Scheme, the applicant must go to the nearest Akhuwat branch to fill in the application forms. The applicant must provide basic details, including name and address, as well as occupation and the reason for the loan. The application is reviewed by the Akhuwat staff. Akhuwat staff determine the creditworthiness of the borrower and their capacity to repay.

Apply Online for Akhuwat Loan Scheme 2024

If you’re looking to apply for the Akhuwat Loan Scheme 2024, be sure to review the eligibility requirements and submit your application by the deadline of the end of the year. It is the Akhuwat Loan Scheme 2024 is an initiative of the Akhuwat Foundation, a not-for-profit company, that provides financial assistance to those who are in need. The scheme grants loans of as much as Tk 20 lakhs to people and small businesses operating in rural areas. This article will tell you everything you need to be aware of this scheme. Akhuwat loan scheme 2024 and the online application procedure.

Akhuwat Loan Scheme 2024

Akhuwat Foundation’s interest-free loan program is available for those who have Pakistani citizenship. You can apply across Pakistan. The different loan options have various amounts of money, however, it ranges from 50000 up and up to 150000 rupees. The cost of application is 200, excluding agriculture. does not require an application form. In the initial step in obtaining a loan is to obtain the interest-free loans Akhuwat Foundation loan application form at Qard-eHasan. Following downloading, note down all the necessary information and then send this form to the AIM branch located near where you live. The manager of the unit reviews the loan application and scrutinizes the additional documents that might be required. They also verify that all the documents are required to be approved for the loan.8171 Ehsaas Program details here.

Akhuwat Loan Scheme 2024 Apply Online www.akhuwat.org.pk

Akhuwat Loan Contact Number

Once the form for application is received The bank will then review the form and decide if it is appropriate to grant you a loan. If you’re approved the bank will then send you an application that contains details about how to apply for the Akhuwat Loan scheme. You must then complete the application form as well as any other necessary evidence to your bank. When these are received the bank will begin taking care of your application and will provide you with regular updates regarding the progress of your loan.

Akhuwat Loan Application Form Pdf

If you’re looking for an efficient and simple method to obtain a loan it is possible that you should consider the Akhuwat Loan Scheme might be the right choice for you. The scheme lets borrowers apply online. The application process is easy and easy. To apply, you’ll be required to fill out the online form. The form is simple to use and all you require to provide is the name of your home address, telephone number, as well as bank details. Once you’ve filled out the application, you’ll be required to upload a few documents to prove your identity of you and your income.

The people of Pakistan have the ability to borrow money to build houses. Certain people own a plot but do not have the money to construct their homes. Therefore, everyone who owns plots or not got a mortgage can borrow and build their homes as per their desires.PM Loan Scheme details check here.

This program is designed for the people in Pakistan who don’t have a house and have to live on the street. There is now no stress for the poor. The applicants just have to submit their applications and are granted loans to build their homes. The principal purpose of the loan is to increase the standard of living in Pakistan.

It is therefore the most important action by the government to increase the standard of living in Pakistan. The entire information available regarding this scheme Akhuwat Loan scheme and the process for applying.

Eligibility Criteria for Scheme

- The applicant should have the correct business plan.

- A person who has an Income Score Card that is less than 40.

- Age range of 18 to 60 years old.

- The applicant must have a an active CNIC.

- The applicant must be financially active.

- The applicant must not be convicted of any criminal offense for which proceedings is in process.

- Applicant must be of good moral and social standing within his local community.

- The applicant must be able to offer two guarantors that are not family members.

Mandatory Points for Eligibility Akhuwat Loan Scheme 2024

- Applicant must possess Pakistani National Identity Card CNIC;

- The foundation will verify Foundation to determine if the applicant is able to run a company and their age must be between 18 and 62 years;

- Candidates aren’t permitted to engage in any illegal activity “Character Certificate Required”;

- The applicant is of excellent character and social status and, at the time of submitting the File He must supply two people to support him.

- The residence of the applicant must be within a reasonable distance from the Office of Akhuwat

Today Jobs

Today Jobs