Jobs Important Dates 2024

| Industry/Company | |

| Job Sector | |

| Important Dates | Posted Date : Last Date : Modified Date : |

| Experience | |

| Offered Salary | Rs. |

| City | |

| Testing Service | |

| Newspaper | |

| Qualifications |

Jobs Total Vacancies

Jobs Eligibility Criteria

Jobs Required Qualifications

- There are following Qualifications are required .

Jobs Online Apply

We’ve given you details on the most current National Bank NBP advance salary loan Application form 2024, as well as an amortization calculator and increase in interest rates. We also provide information on the conditions and terms that apply to the scheme. National Bank of Pakistan advance loan scheme 2024 could be a possibility that is available to people employed in the public sector. The National Bank of Pakistan Loan Scheme is a great option for service and regular workers who want to take advantage of cash advances. It is among the best publicly-owned banks in Pakistan and offers different loans to NBP account holders Federal employees, semi-government employees, and employees from members of the Armed Forces.

The scheme is open to employees of the provincial government sector or the Federal government sectors. If you work in a semi-government organization, then you are eligible to apply for the National Bank of Pakistan NBP Salary loan scheme. We know that this institution is among the biggest and most well-established public sector banks in Pakistan. It is a federal institution and it acts as an agent for the State Bank of Pakistan.

This bank, which is called the National Bank of Pakistan, is operating this wonderful scheme specifically designed for permanent employees of the federal government as well as provincial government agencies. Even if you work in local authorities or work for the armed forces are eligible to apply for this program. If you are employed in one of the semi-government institutions, they could apply.

NBP Advance Salary Loan Scheme 2024 Application Form

NBP Salary Loan Scheme 2024

- Permanent employees who are being paid through NBP are able to apply

- employees of Semi-government and autonomous bodies may also use it on the basis of their pay slips

- The applicants can receive up to 20 salaries from Advance as well as the highest sum to this type of loan has been increased to 200000

- No minimum income, collateral, or insurance costs are necessary

- The maximum duration for NBP Advance salary is 5 years.

- The applicant’s age is not more than 59 and 6 months as of the point of attaining maturity

- The loans will be made at a low rate of markup

- Anyone who is applying to this scheme for the 2nd time will be eligible for discounts, too.

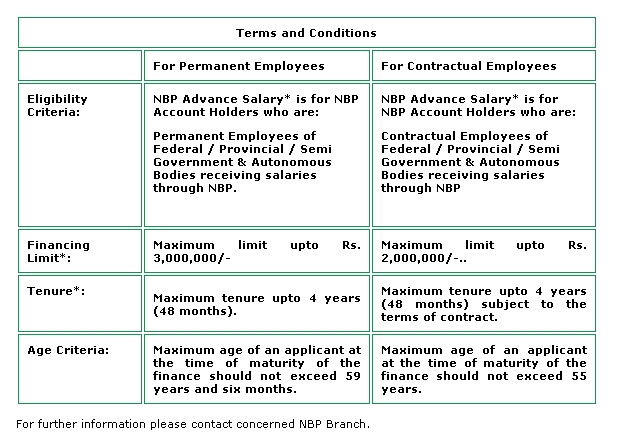

Terms & Conditions For NBP Advance Salary Loan Scheme 2024

1. The National Bank of Pakistan (NBP) offers a loan to advance salaries that have the lowest markup rate in the market at just 19%.

2. you can repay your loan in as low as two payments, or up to sixty.

3. In comparison to other advance salary schemes, 3NBP’s advance salary time for loan applications and approvals is considerably shorter.

4. It is important to note that there isn’t required to pay a minimum wage, collateral or insurance cost to be covered under NBP’s advance salary program 2024. NBP Advance Salary Program in 2024.

5. The only permanent, government-appointed semi-government and school employees who earn their advance salary through NBP are qualified to apply for the NBP Advance Salary Program in 2024.

6. Up to 20% of your take-home earnings are offered to you. The maximum amount is 2,000,000 Rupees.

7. The NBP Advance Salary Financing loan comes with a maximum repayment period of 60 months (Five Years).

8. Your advance salary loan must be paid off prior to the time you reach 59 years old and six months old.

9. The cost of application is the higher of two percentages of the amount loaned, or two thousand rupees.

10. The application for the NBP advance salary loan can be downloaded by clicking on the link below.

Check also: Askari Bank Online Registration Form

NBP Markup Rate 2024 Advance Salary Loan

It is worth noting that the National Bank of Pakistan (NBP) has launched an advanced salary credit, which has the lowest markup in the business at 19 percent. The first thing to consider is ensuring there is a steady source of revenue. Additionally, you can use payday loans to cover emergencies that you never thought of. Payday loans are a great way to improve your credit score and enhance your credit score.

Documents Required For NBP Salary Loan 2024

* Three months’ pay slips, salary, or certificates.

* Request for rollover by the customer (Just in the event in the event of a rollover).

* You must supply 5 post-dated crossed cheques to the National Bank of Pakistan covering the entire amount of the loan.

* You need to include copies of your Computerized National Identity Cards for the borrower and two references (duly certified by the concerned National Bank of Pakistan branch or any other officer with a gazetted stamp) in the application form.

* You might be required to submit copies of your ID cards as well as references. The identity cards must be endorsed by an NBP Branch /Gazetted Officer).

• You’ll be required to sign an undertaking on a stamp paper of 20 rupees.

* Its also mandatory to provide CF1 undertaking (Details of various facilities/loans/Credit cards etc taken from other banks including the National Bank of Pakistan)

How to Apply for NBP Advance Salary Loan

The National Bank of Pakistan advance salary loan scheme 2022 has recently begun and is now open for you to apply according to the process that is outlined.

- The applicant is able to fill out this NBP Advance Salary Loan Application Form from the provided link

- After you have downloaded this application form, go to the branch of your bank for more details.

- It is required to submit the most recent three-month pay receipt, CNIC photocopy, and two references. Certain conditions may have to be met for this lending program.

- You must bring the completed application form along with the certificate of authorization to the branch of the bank that holds your account.

- Submit the form, and wait for confirmation from the officials.

NBP Advance Salary Loan Markup Rate

The NBP Salary Advance Loan markup interest rate calculator hasn’t been made public on the Internet. Anyone who wants more information about the markup of interest can visit the relevant National Bank of Pakistan Branch.

Jobs Last Date Application Form

Last Date of Application Form Submission is|

|

|