Jobs Important Dates 2024

| Industry/Company | |

| Job Sector | |

| Important Dates | Posted Date : Last Date : Modified Date : |

| Experience | |

| Offered Salary | Rs. |

| City | |

| Testing Service | |

| Newspaper | |

| Qualifications |

Jobs Total Vacancies

Jobs Eligibility Criteria

Jobs Required Qualifications

- There are following Qualifications are required .

Jobs Online Apply

You can check the PM Youth Loan Scheme 2024 Online Application Form on this page. Are you prepared to take advantage of the entrepreneurial potential in Pakistan? Now, the PM Youth Business Loan Scheme 2024 is available in simple and straightforward terms. The youth of Pakistan is the backbone of the country, and their potential needs to be harnessed to drive the nation forward. To achieve this, the government of Pakistan has launched the PM Youth Loan Scheme 2024, which aims to provide financial assistance to young entrepreneurs and individuals who want to start their own businesses. The PM Youth Loan Scheme 2024 is a flagship program of the government, which is designed to promote entrepreneurship and self-employment among the youth of Pakistan. The scheme offers loans ranging from Rs. 100,000 to Rs. 5 million, which can be used for starting a new business or expanding an existing one.

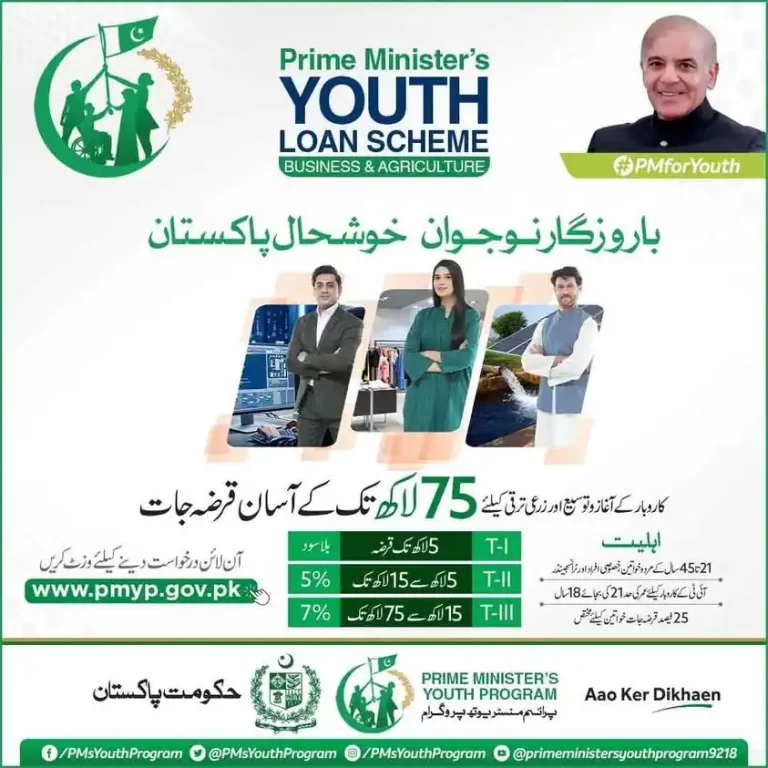

A new initiative has been launched by the Government of Pakistan to support bright young entrepreneurs. Prime Minister Shahbaz Sharif recently launched the Youth Business Loan Schemes and Agricultural Loan Programs to encourage self-employment and a norm for job creation among youth in Pakistan. People between the ages of 21 and 45 can apply for loans up to 75 lacks through the PM’s Youth Loan program to help them start their own businesses. For those who are interested in the IT or e-commerce sector, however, the minimum age is 18.

The loan amount of PKR 0.5 million will not be charged interest. PKR 0.5 million to 1.5 million loans will attract 5% interest,” said the prime minister during the Islamabad launch ceremony. On loans exceeding PKR 1.5 million to PKR 7.5 million, a 7% interest rate is applicable. Youth in rural areas will be able to use the loan facility to help them introduce and encourage advanced technology in agriculture. This innovation could help businesses be more sustainable, more environmentally friendly, safer, and ultimately, more profitable.

PM Youth Loan Scheme 2024

Prime Minister launched the PM Youth Loan Scheme 2024 and provided the Youth of Pakistan with access to business loans. The PM Kamyab Jawab Interest-Free Loan Scheme for Own Business has begun today, and the Government of Pakistan has begun accepting applications. The national bank of Pakistan would grant fifty percent loans for the PM Kamyab Jawab program. 50% of all other banks are accountable. Applicants may also obtain the Loan Application Form from the Kamyab Jawab website, kamyabjawan.gov.pk. The online loan application is now available for students and young people. The scheme is open to all Pakistani citizens between the ages of 21 and 45, who have a viable business idea and a passion for entrepreneurship. The loans are interest-free, and the repayment period ranges from 1 to 8 years, depending on the size of the loan.

The scheme has a simple application process, which can be completed online or through designated banks. The applicants are required to submit a business plan, which will be evaluated by a panel of experts. Once the plan is approved, the loan will be disbursed to the applicant’s bank account.

prime minister youth program online apply

The loans will be made for working capital as well as term loans up to 8 years.The limit on female loan applicants is 20% to be reserved. The loan ranges from one lakh up to 5 lakh is provided on personal guarantee. If you are able to borrow more than 5 lakh, the banks are accountable to verify all business details and look into any concerns.Prime Minister Youth Program launched by prime minister Shahbaz Sharif, as per the following advertisement the last date for submission of the application form is January 30, 2024. The Government of Pakistan has unveiled a new program to assist brilliant students to pursue their entrepreneurial ambitions. The Prime of the government Shahbaz Sharif has recently launched the Youth Business and Agricultural Loan schemes to encourage self-employment and an environment of job creation among youth across the country.

Prime Minister Youth Loan Scheme 2024

Mr. Shahbaz Sharif, the Pakistani Prime Minister, has announced the Prime Minister Youth Loan Scheme 2024 for Business and Agriculture. The fundamental objective of this interest-free and interest-bearing loan program is to promote youth employment and prosperity. Do you plan to start a business? The Prime Minister Youth Loan Program 2024 – Online Application is the best alternative for young business owners. This lesson will provide a comprehensive overview of the Prime Minister’s Youth Loan Scheme 2024, including its eligibility conditions and online application procedure. Loan amounts, processing deadlines, and other details of the Prime Minister Youth Loan Program 2024 will also be discussed.

PM Youth Loan Scheme 2024 Online Application Form

Documents Required for PM Loan Scheme 2024 for Youth

- A passport-sized CNIC photograph (front and back)

- Educational credential/diploma (if applicable)

- Evidence of experience (if applicable)

- Registration/licensing with a business chamber (if applicable)

- A recommendation letter from the pertinent chamber, trade association, or labor union (mandatory in case of existing business).

Prime Minister Youth Loan Program Online Apply

Prior to initiating the application process, candidates must have their National Tax Identification Number available. They can obtain one by visiting the Federal Board of Revenue’s website. In addition, they must present a consumer ID with their current address, an office address, and a utility bill. Applicants must also submit the contact information for two references who are not blood relatives, as well as the registration number of any vehicle registered in their name (if applicable). Prime Minister Youth Loan Program Online Apply through this web page. Applicants for established businesses must provide evidence of their actual monthly business income, expenses, and additional sources of income (if applicable). Also, check Ehsaas Program details here.The PM Youth Loan Scheme 2024 has several benefits for young entrepreneurs. Firstly, it provides access to capital, which is often a major hurdle for startups. Secondly, it encourages innovation and creativity, which are essential for building a thriving business. Thirdly, it creates job opportunities, which can help reduce unemployment in the country.

Moreover, the scheme also provides training and support to young entrepreneurs, which can help them develop their skills and knowledge. This includes business management training, financial management, marketing, and other essential skills.

Bank Names

- Meezan Bank Limited

- Allied Bank Limited

- Bank Al Falah

- Habib Metropolitan Bank Limited

- MCB Islamic Bank Limited

- Albaraka Bank Limited

- Askari Bank Limited

- Dubai Islamic Bank Limited

- JS Bank Limited

- Sindh Bank Limited

- Bank Al Habib

- Bank Islamic Pakistan Limited

- Bank of Khyber

- Bank of Punjab

- Faysal Bank Limited

- First Woman Bank Limited

- Habib Bank Limited

- Soneri Bank Limited

- United Bank Limited

- MCB Bank Limited

- National Bank of Pakistan

Eligibility Criteria for PM Bussiness Loan Program 2024

- For brand-new businesses, it is vital to estimate these figures.

- To submit an application, applicants must register with a cell phone number that is registered in their name. Depending on the amount of accessible information, the application process could take at least 15 minutes. Applicants are permitted to save a draught prior to submitting it.

- After submitting the form, applicants will receive an SMS containing their application registration number. They can always monitor the status of their application on this website.

- When the application progresses to the subsequent processing step, SMS messages will be sent.

- For the application to be successfully submitted and evaluated, applicants must ensure that all information on the form is valid and current.

- The prime minister youth loan program 2024 provides entrepreneurs and young business owners with the opportunity to get finance for their ventures, allowing them to thrive in their respective industries.

- The program offers affordable interest rates and a flexible repayment plan to match the needs of each borrower.

PM Youth Portal Guide

- All information provided on the Kamyab Jawan Yes Program is nearly identical to this lending program.

- All men and women between the ages of 21 and 45 with business potential and a valid CNIC are eligible. For firms associated to IT and E-commerce, the minimum age requirement will be 18 years.

- Small and medium enterprises (startups and existing businesses) as defined by the SBP and held by youngsters in the age ranges listed above are also eligible.

- For IT/E-Commerce-related firms, a high school diploma or its equivalent will be required.

- This program is designed for both new and current micro and small businesses.

- You can always reapply if you wish to take advantage of the recently announced rise in the maximum loan amount.

- No physical applications are permitted. Every application must be submitted online.

- At the time an application is submitted, the candidate must be at least 21 years of age. However, the minimum age is reduced to 18 for individuals applying to IT or computer-related firms. The maximum age limit at the time of application submission is 45 years.

PM Shahbaz Sharif Loan Scheme

At least one business partner or director’s age must be within the range specified by this scheme (21-45 years).

There is no standard requirement for a minimum level of education, yet banks will regard it favorably when making decisions. In the event of firms that demand specific qualifications, certifications, diplomas, authorizations, or licenses, the candidate must possess them.

In this PM Youth Loan Scheme 2024, there is no discrimination based on gender, and all applicants are granted equal possibilities. Despite this, a minimum of 25% of all loans are reserved for women in order to ensure gender equality.

Installments/Repayment of PM Business Loan 2024

- Debt repayment can be done in equal monthly, quarterly, biannual, or annual payments. Nonetheless, the specific business kinds and the banks’ choice would determine the precise repayment periods. Negotiating these conditions with the bank when the loan is approved is encouraged.

- Plan permits a grace period of up to one year. The precise grace period, however, would be decided by the banks and the particular business kinds. Negotiating these conditions with the bank when the loan is approved is encouraged.

- During the loan term, applicants have the option to make early payments, which will lower the principal portion of their obligation.

- The number of balloon payments is unrestricted.

Only loans that are regular, meaning there are no past-due payments, allow borrowers to make balloon payments. - While making a balloon payment, a borrower can choose to shorten the loan’s payback time, have the installment amount lowered, or combine both of these options.

- Before the loan’s maturity date, the borrower may pay off the loan in full at any moment.

FAQS

Q: What is the PM Youth Loan Scheme of 2024?

A: A government initiative offering financial support to young entrepreneurs.

Q: Who is eligible for Kamyab Jawan?

A: Pakistani citizens aged 18-45.

Q: What is the Interest Rate of the Prime Minister Youth Loan Scheme?

A: Interest rates depend on the loan amount and business type.

Q: How long does it take for approval of a PM Youth Loan?

A: Approval times vary and depend on each case individually.

Jobs Last Date Application Form

Last Date of Application Form Submission is|

|

|