Jobs Important Dates 2024

| Industry/Company | |

| Job Sector | |

| Important Dates | Posted Date : Last Date : Modified Date : |

| Experience | |

| Offered Salary | Rs. |

| City | |

| Testing Service | |

| Newspaper | |

| Qualifications |

Jobs Total Vacancies

Jobs Eligibility Criteria

Jobs Required Qualifications

- There are following Qualifications are required .

Jobs Online Apply

Are you planning to sign up for your mobile phone through the PTA in order to pay the necessary tax? If so then you’ve found the right website. Here, you’ll find out what you need to do to make payments for tax on your Mobile registration tax for PTA. Therefore, you should stick here for a couple of minutes.

In the year 2018, PTA launched the DIRBS (Device Identification, Registration, and Blocking System) to reduce the risks that come with the illicit use of mobile devices within the country. To do this, PTA started blocking devices that were not registered. In the event that you own a mobile device that is not in compliance in accordance with the PTA and you wish to be able to make payment for the tax on mobile registration at your convenience at home, follow the steps below to discover how this is done.

Anyone who doesn’t want their mobile phones to be blocked from using them can register today using PTA through the payment of required taxes. Paying mobile device taxes is easy and can be accomplished on the internet by following some simple steps. In this post, we’ll try to provide step-by-step directions on how to pay PTA Tax online. Let’s talk about this in a brief manner.

How to Pay PTA Tax Online 2024| Pay PTA Mobile Registration Tax

Steps to Pay PTA Tax Online

The procedure for the process of paying PTA tax online is explained in greater detail below. Simply follow these simple steps!

- Register an account on the DIRBS official website.

- To pay PTA taxes The first thing you have to establish an account and log on to the Device Identification Registration and Blocking System (DIRBS) website.

- Once you have landed on their site it is necessary to sign-up through their portal.

- The next screen will show certain notifications will be displayed with important guidelines. Read them and adhere to them.

- Then, you’ll be required to fill in areas by choosing from the drop-down menu. Fill in your reason for using the form. Choose your “personal” or “commercial” type option. Be aware that choosing the “commercial” option can be used by importers and organizations that have registered themselves through the Federal Board of Revenue (FBR).

- After selecting the goal, then you can choose the “user type” from the available choices. There are two choices: Pakistani (local, international traveler Dual country) as well as Foreigner (Travelled with Visa). Choose your preference and proceed to the next stage.

- Fill out the required fields and click the “Submit” button.

- Before you sign in, verify that the email you have provided is correct since PTA will send you an email to verify your account.

check Also: How To Register An NGO In Pakistan Complete Requirements And Procedure

Certificate of Compliance (COC)

- Once you’ve completed the above steps after which, input your email address and password to log in to your registered and created PTA account.

- Find your Individual Certificate of Compliance (COC) option. This is visible on the left side of your screen, just below the heading “Dashboard”.

- Choose”Individual COC” “Individual COC”, now various options will be available within the area. Choose “Apply for COC” for further steps.

- It doesn’t matter if are a resident or an international traveler choose the option of your preference. International travelers will need to input their passport numbers.

- If you are a mobile user in the local area you can enter your mobile number using the name of the operator, such as Jazz/Warid, Telenor, Ufone, or Zong.

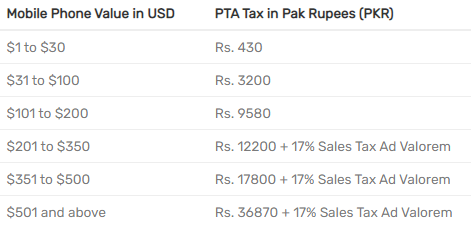

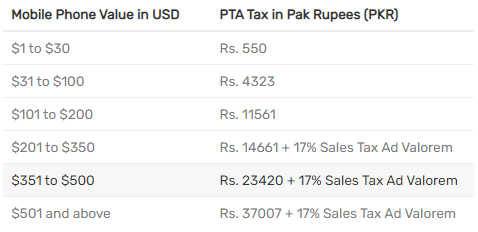

Mobile Phone PTA Tax Calculator (Passport)

Mobile Phone PTA Tax Calculator (CNIC)

Checking Device’s IMEI Numbers

- Then, you can check and select the right option for the number of Sim slots available on your smartphone that is not Pta. Some phones have one three, two, and even 4 slots. It all depends on the phone manufacturer.

- Provide the IMEI number that is provided for each SIM slot.

- Verify your phone’s IMEI number(s) by dialing *#06# with the keypad.

- Generate a Payment Slip Identity (PSID)

- After you have entered your IMEI number for your device then a unique PSID will be generated.

- Make use of the PSID for paying the PTA taxes that are imposed on your smartphone, and then make it an eligible device for PTA.

- PTA mobile taxes can be paid online by any bank with an immediate bank transfer. Payments can also be done via several popular mobile wallets.

This is the entire procedure of how to pay the PTA Mobile registration taxes. Should you need to ask any queries about the process you can inquire in the comment section.

Jobs Last Date Application Form

Last Date of Application Form Submission is|

|

|