Jobs Important Dates 2024

| Industry/Company | |

| Job Sector | |

| Important Dates | Posted Date : Last Date : Modified Date : |

| Experience | |

| Offered Salary | Rs. |

| City | |

| Testing Service | |

| Newspaper | |

| Qualifications |

Jobs Total Vacancies

Jobs Eligibility Criteria

Jobs Required Qualifications

- There are following Qualifications are required .

Jobs Online Apply

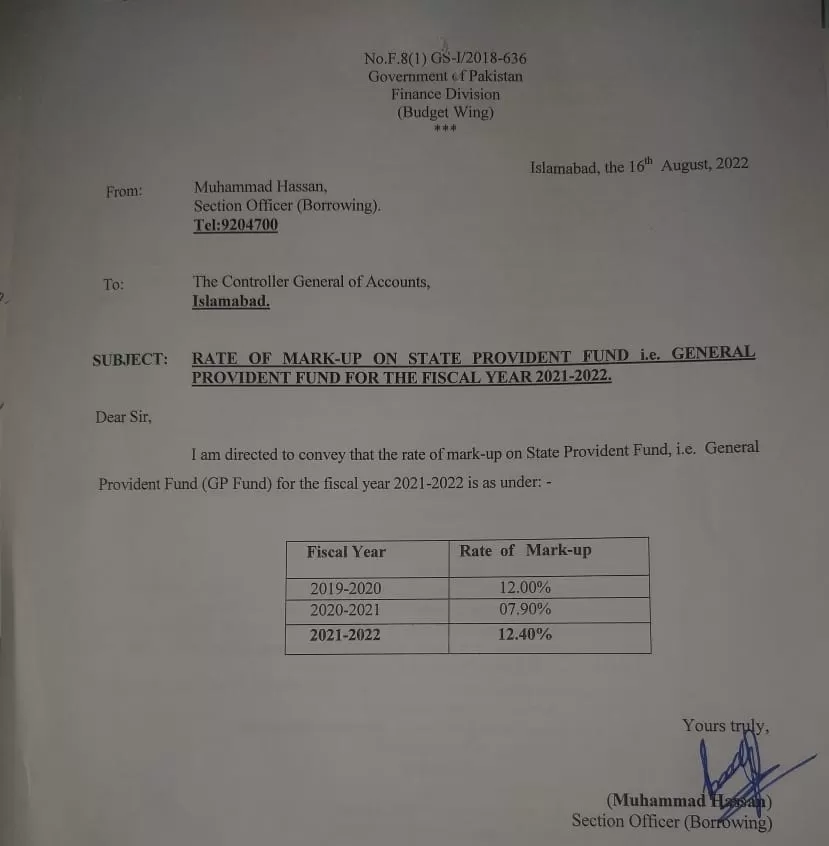

Punjab GP fund deduction rates 2024, effective October 20,22 as follows. Punjab Government Finance Division revised GP fund rates effective October 2024.GP Fund Deduction Rates 2024 Notice was released on October 17th, 2024. The Governor of Punjab is delighted to approve the following changes in the Punjab General Provident Fund Rules 1978, which will take immediate effect.

The deduction on the basis of the rates below is effective from the October pay in 2024 due in November 2024.

The subscriber must pay monthly fees according to the scale of Basic Pay outlined in table 1. The subscriber shall pay at the same rate as that listed in column 2.

Punjab GP Fund Deduction Rates 2024 Applicable From October Below

GP Fund Upgradation Notification 2024

Table Chart of Revised GP Fund Subscription Rates 2024

| Sr. No | Minimum Basic Pay | Maximum Basic Pay | Average Basic Pay | Monthly Subscription of General Provident Fund (GP Fund) |

| 1 | BPS-01 | 13550 | 26450 | Rs. 600/- |

| 2 | BPS-02 | 13820 | 28520 | Rs.1060/- |

| 3 | BPS-03 | 14260 | 31660 | Rs.1150/- |

| 4 | BPS-04 | 14690 | 34490 | Rs.1230/- |

| 5 | BPS-05 | 15230 | 37730 | Rs.1330/- |

| 6 | BPS-06 | 15760 | 40960 | Rs.1420/- |

| 7 | BPS-07 | 16310 | 43610 | Rs.1500/- |

| 8 | BPS-08 | 16890 | 46890 | Rs.1600/- |

| 9 | BPS-09 | 17470 | 50170 | Rs.1700/- |

| 10 | BPS-10 | 18050 | 53750 | Rs.1800/- |

| 11 | BPS-11 | 18650 | 57950 | Rs.1920/- |

| 12 | BPS-12 | 19770 | 62670 | Rs.3300/- |

| 13 | BPS-13 | 21160 | 67960 | Rs.3570/- |

| 14 | BPS-14 | 22530 | 74730 | Rs.3900/- |

| 15 | BPS-15 | 23920 | 83320 | Rs.4290/- |

| 16 | BPS-16 | 28070 | 95870 | Rs.4960/- |

| 17 | BPS-17 | 45070 | 113470 | Rs.6350/- |

| 18 | BPS-18 | 56880 | 142080 | Rs.7960/- |

| 19 | BPS-19 | 87840 | 178440 | Rs.10660/- |

| 20 | BPS-20 | 102470 | 196130 | Rs.11950/- |

| 21 | BPS-21 | 113790 | 217670 | Rs.13260/- |

| 22 | BPS-22 | 122190 | 244130 | Rs.14660/- |

Minimum Rates of Subscription

The Minimum rates of subscription (on mean) will be as under:

| Sr. No | Basic Pay Scale No | Subscription rates |

| 1 | BPS-01 | 3% |

| 2 | BPS-02 to BPS-11 | 5% |

| 3 | BPS-12 to BPS-22 | 8% |

Ways to use GP Fund

Three ways you can use the account GP Fund. 1st Refundable 2nd Non-Refundable and 3 rd Final Payment

Refundable GP Fund

If you are less than 50, you may make an application for the refundable GP Fund. In this case, you will receive 80 percent of the GP Fund balance. If you’re trying to get GP Fund refundable, you can return it in 36 installments.

Non-Refundable GP Fund

If you’re older than 50 years old You can apply for a non-refundable GP Fund. This means that you may take advantage of this amount. GP Fund amount is nonrefundable. You can even get a 100 percent GP Fund amount which you are not able to return in any installment. This is known as the Non-Refundable GP Fund.

Final Payment GP Fund

When a person retires from service, they are eligible for the Final Payment of that GP fund. If someone dies during their service, also spouses are entitled to take the GP Fund’s final payment after the death of the deceased. In this case, they may claim the entire remaining balance from the GP Fund as the Final Payment.

Jobs Last Date Application Form

Last Date of Application Form Submission is|

|

|